Building a Loss Communication Plan

By Joe Anderson, CPCU, ARM AFSB, CBRA

Principal & Fractional Chief Risk Officer

Loss/Claims Management begins with understanding the dynamics of a claim and who the various parties are that relate to the loss. Insurance claims are a subset of losses to the overall organization. In workers’ compensation alone, it is estimated that each dollar of claim is multiplied by four to determine the overall impact to the organization. This is why I use the term “loss” instead of “claim”. So, this makes it even more important to not only avoid losses altogether but also manage them well.

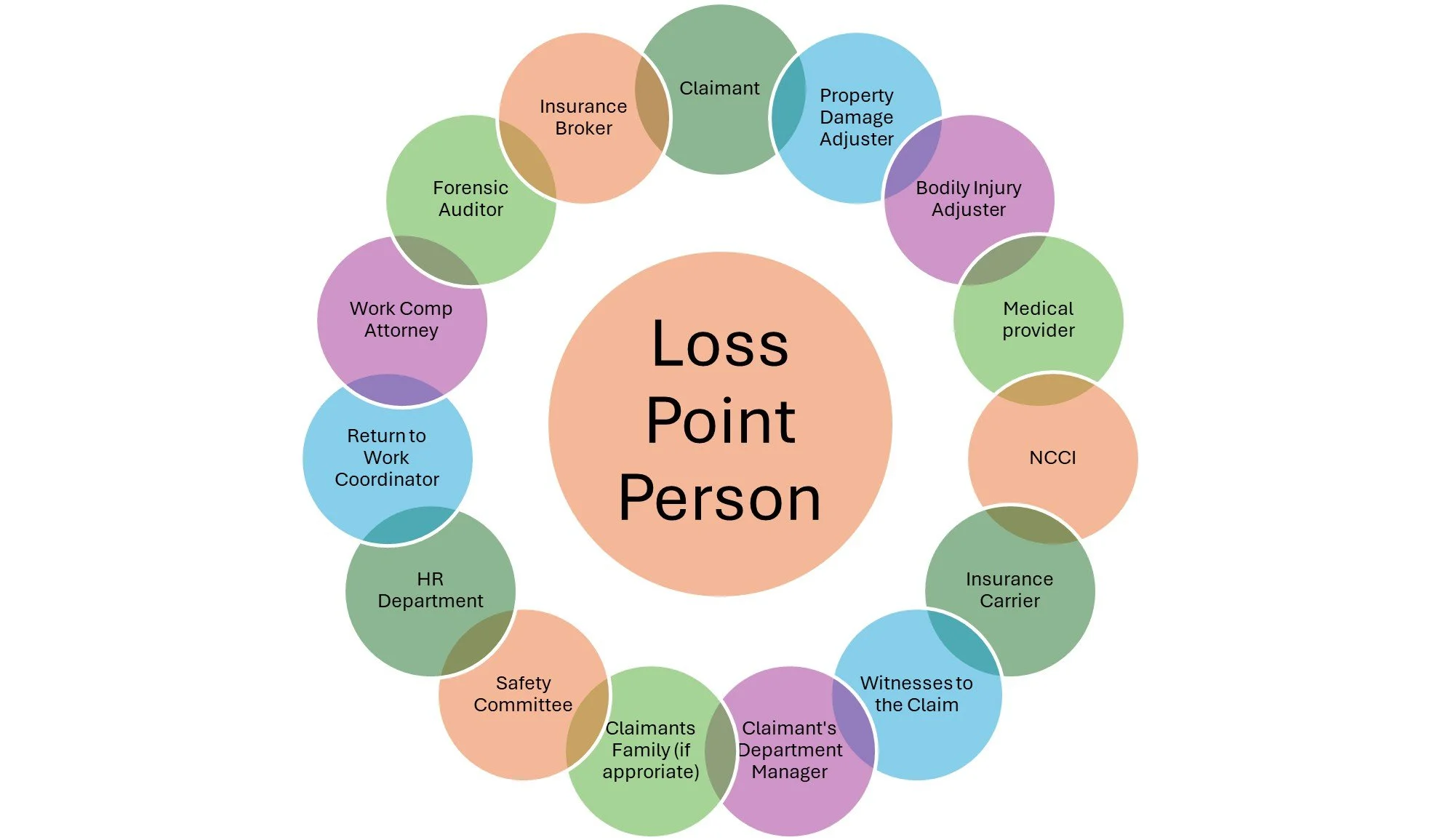

I count 15 parties involved here, and I am not even breaking down the Medical Providers. So how does one keep all these people straight and manage the communications to streamline for best adjusting, settling, and closing out of a loss This is the question many Claims Managers have asked.

Understanding the dynamics of how a loss starts, develops, and closes can be helpful. A loss does not just start with damage or injury. The potential for the loss must be evaluated ahead of time. It starts with the behavior or plant condition that gave rise to the loss.

We must look at communication between the company and the department manager. How have they prepared this manager to properly communicate to the claimant about how they should deal with the claim and how the company will respond? Are they trained to gather all the information for an A+ loss submission? This can make a big difference in the outcome of the claim. Having a claimant communication plan that frequently updates them keeps them happy and avoids unnecessary legal involvement, which always drives up the claim.

You have the initial incident report taken from the claimant. The language used to communicate to the claimant is critically important. This can be a non-injury accident report to start, as we want to gather information as soon as we can for any incident that can cause organizational loss. A detailed and signed statement is taken (the more detailed, the better for multiple reasons). If you can record it, it is even better. Then, pictures are taken of the location of loss or injured body part, and the related equipment involved. Any responding police or fire reports are included. And witnesses are identified and signed statements are taken. Think about what the claims manager might want to know. Provide even more. Use the “Who, What, Where, When, How” questioning methodology to make sure your work here is as thorough as possible.

The loss (now a claim), is reported to the insurance company. This communication happens primarily with the adjuster. However, on larger claims, notifying the underwriter can be helpful for better insurance renewal terms and pricing. This is a good checkpoint to notify the claimant of activity too.

The adjuster then sets up the reserve for the claim. This is done by communicating with the claimant and the relevant medical or restoration providers to fix the damage and/or repair the body. The in-house claims manager wants to get granular (or detailed) here, specifically on sub-reserves and follow-up timelines. This info is then shared with the company HR department for rehiring, return-to-work, or temp needs. It is also reported to the safety committee and the department manager of the claimant. Follow-up dates are set for updates to the claim from the different “involved parties”, but mainly with the adjuster.

The HR department and the Supervisor will discuss how to minimize the loss impact to the organization. This might involve hiring a temporary replacement, shifting the workload to other teammates, outsourcing some of the work, or other steps.

Because there are so many people involved in a loss to an organization, claims can seem to, at times, get “lost in space” like a ship in the Bermuda Triangle. To avoid this, managing a claims follow-up timeline is critical. It is also critical to set expectations, deadlines, and discuss settlement options with the adjuster up front.

At times, the adjuster will hit a brick wall in their process. If you ask them frequently if they have hit any bottlenecks in the claim, they may share with you that the medical provider is sitting on a report or the claimant is not responding, etc. The in-house claims manager can become an advocate for the claims adjuster here. This builds long-term rapport and will often help your claims get worked on quicker and at a higher priority.

Finally, as the damaged property is repaired and/or the person is healed up, there comes a time to settle the claim. This can be a challenging process, as claims adjusters may get busy and this process gets stalled. Most adjusters are motivated to close with the right information. Discussing all the claim settlement options is a critical step, not only with the adjuster, but with the company personnel and/or the claimant. Getting legal advice as to settlement documents can also be a smart move.

In conclusion, a great claims communication strategy has these components:

Pre-Loss Causation Assessment & Prevention

Supervisor Training on Loss Communication

Initial Incident Report/Information Gathering

Reporting the Claim with a Complete Claims File

Adjuster Reserving

Claims Timeline Monitoring for Updates

Adjuster “Brick Wall” Workarounds

Claims Settlement

Great communication throughout the process can reduce the duration and dollar amount of the claim substantially!